How DipSkip Works

Understand the core concepts behind DipSkip's trading automation platform

What is DipSkip?

DipSkip is an intelligent strategy automation platform built on DipScript — a human-readable language for defining trading logic. Remove the complexity of traditional programming while maintaining full control over your trading decisions.

Plain English Logic

Write trading rules in clear, readable text

Real-time Processing

Line-by-line script interpretation

Market Integration

Direct connection with trading platforms

Complete Strategy Example

Here's a real-world momentum trading strategy in DipScript:

TICKER NVDA

// Define investment amount variable

SET $BAMOUNT = 75000

// Initial entry: buy if we have no position yet

IF $LAST_BUY_PRICE = NULL THEN OBTAIN USD $BAMOUNT @ $MARKET_PRICE

// Trailing stop: sell when profit drops 2% from peak

IF $PROFIT > 500 AND $PROFIT < $PEAK_PROFIT - 2% THEN SELL $ALL @ $MARKET_PRICE

// Re-entry: buy back when price rises 2.5% from bottom

IF $ALL = 0 AND $MARKET_PRICE > $LOWEST_PRICE + 2.5% THEN OBTAIN USD $BAMOUNT @ $MARKET_PRICE

This strategy uses USD-based position sizing, percentage-based trailing stops, and momentum re-entry logic—all in just 6 lines of readable code.

The 5 Core Commands

DipScript provides five fundamental commands that form the building blocks of any trading strategy. Simple, powerful, and easy to learn.

TICKER

Specify which stock to trade. Must be the first command in your script.

IF / THEN

Create conditional logic using variables, operators, and values.

OBTAIN

Reach a target position size—only buys what's needed.

SELL

Sell a quantity of shares at market price or a specified limit price.

STOP

Immediately halt script execution. Useful for emergency stops or end conditions.

Automate Based on Live Market Conditions

DipSkip continuously evaluates your strategy against live market data. Set up triggers based on price movements, profit targets, volume changes, and more.

THEN SELL $ALL @ $MARKET_PRICE

Rules are reactive and fully customizable — you define the thresholds, DipSkip handles execution.

Line-by-Line Evaluation

DipSkip processes your script from top to bottom. Each line is evaluated independently for true/false logic. When conditions are met, corresponding actions execute through your brokerage API.

Read Line

Parse command syntax

Evaluate

Check conditions against live data

Execute

Perform trade action if true

Work With Dynamic Variables

DipScript provides built-in variables that automatically track your trading performance, position data, and market conditions in real-time.

Profit & Performance

Position & Trading

Price Tracking

Trade History & Counting

Account & PDT

Stock Information

Custom & Macro Variables

SET $DIP_DETECTED = $MARKET_PRICE < $PEAK_PRICE - 5%

// Use the macro in your logic

IF $DIP_DETECTED AND $ALL = 0 THEN OBTAIN USD 10000

Macro variables: Create reusable conditions like $CAN_DAY_TRADE or $DIP_DETECTED that expand and resolve automatically. Nested variables are resolved recursively up to 10 levels deep.

Monitor Strategy Performance

Get real-time visibility into script status, trade outcomes, and market conditions. Configure alerts for important events and stay informed about your automated strategies.

Smart Alerts

Profit targets, failed orders, threshold breaches

Performance Tracking

Real-time P&L, win rates, execution history

Risk Management

Position limits, drawdown protection, safety stops

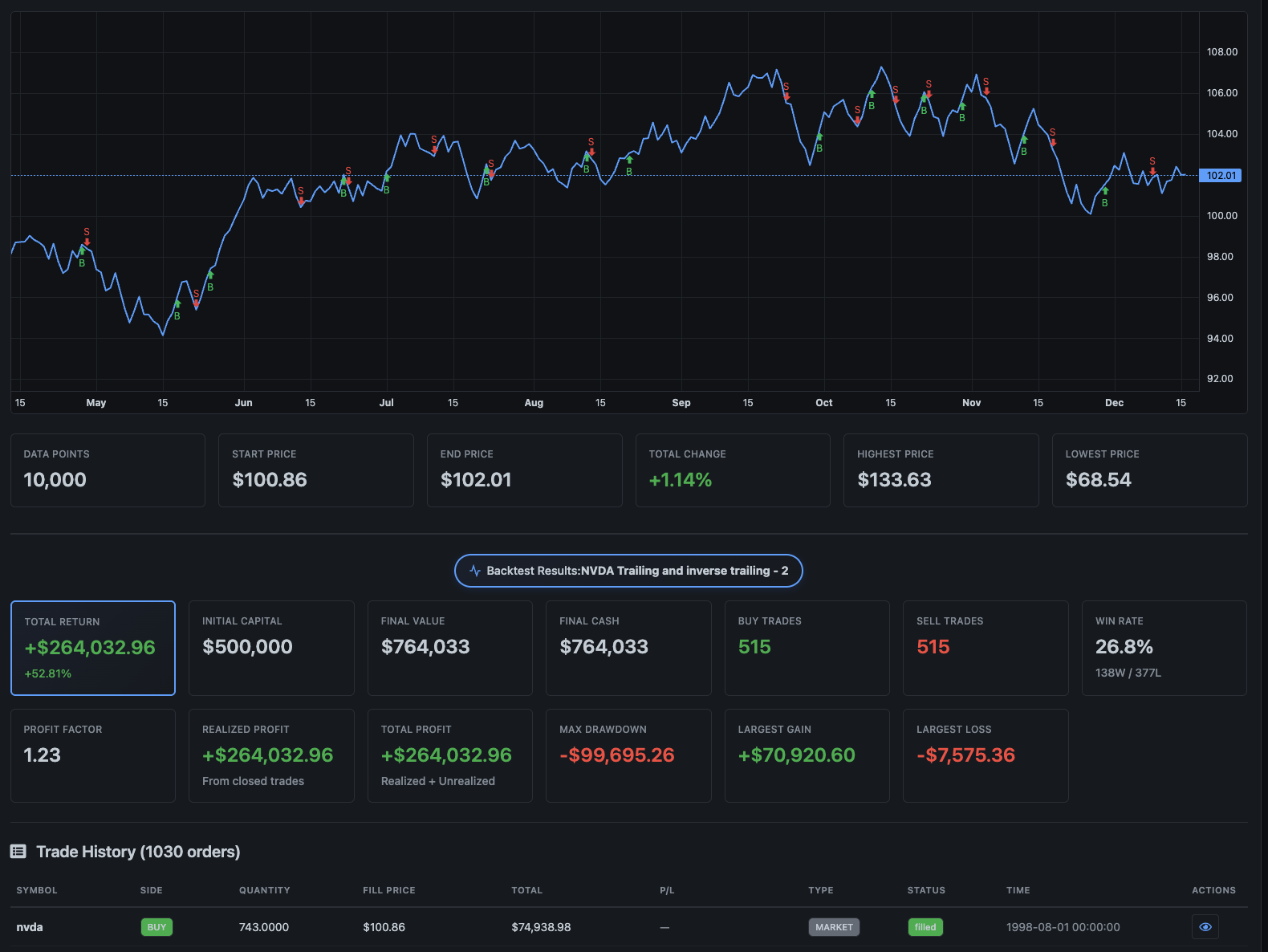

Test Before You Trade

Every successful trader knows that strategy validation is critical. DipSkip's built-in backtester lets you simulate your trading logic against years of market data—identify weaknesses, optimize parameters, and build confidence before going live.

Risk-Free Experimentation

Test aggressive strategies, fine-tune profit targets, and experiment with different market conditions—all without risking a single dollar.

Data-Driven Decisions

See exact win rates, total returns, and trade-by-trade breakdowns. Know your strategy's strengths and weaknesses before committing capital.

Rapid Iteration

Adjust a variable, re-run the test, and see results instantly. Iterate through dozens of strategy variations in minutes instead of months.

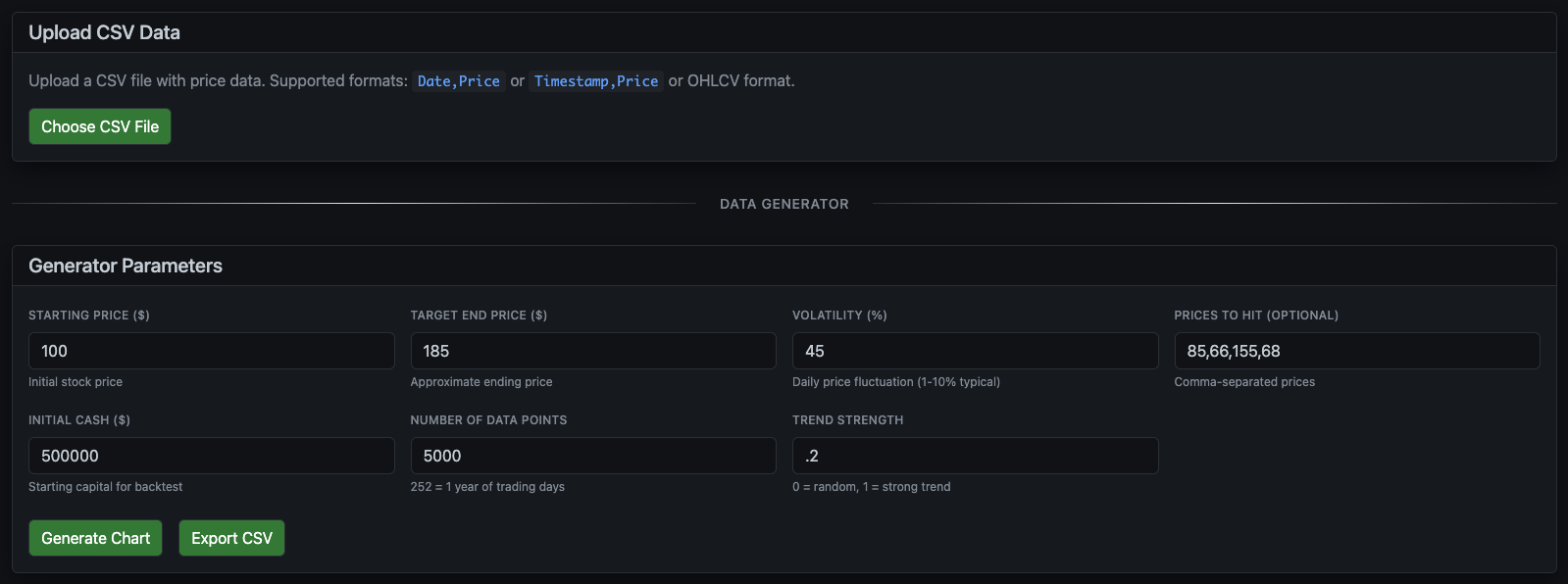

Generate synthetic data or upload your own CSV files

Visualize price data with interactive charts

Analyze performance metrics and trade history

Flexible Data Options

Upload CSV data from any source, or use the built-in generator with customizable volatility, trends, and target prices.

Full Script Compatibility

Backtests run the exact same DipScript logic as live trading. What you test is what you get.

Detailed Trade Log

Review every simulated trade with timestamps, prices, quantities, and profit/loss breakdowns.