Stay Informed: Email Alerts for Your Trading Scripts

Automated trading means you don't have to watch the market constantly. But "set it and forget it" doesn't mean you want to be completely in the dark. DipSkip's alerts system bridges this gap perfectly—your scripts run autonomously while you receive email notifications about the events that matter most to you.

Why Alerts Matter

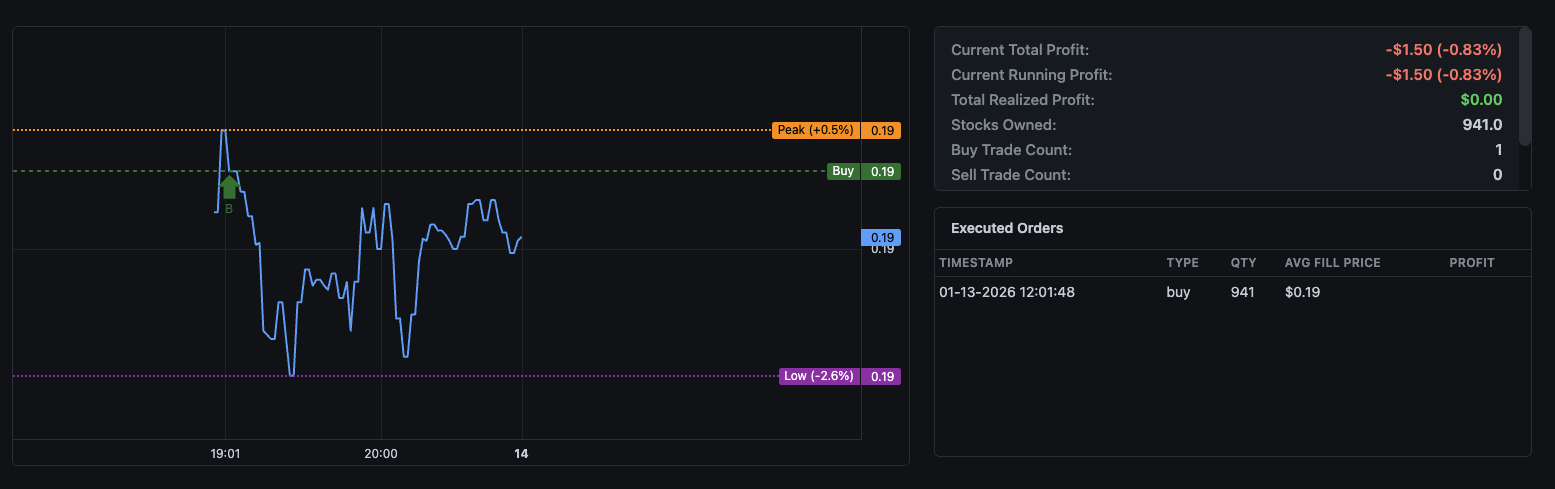

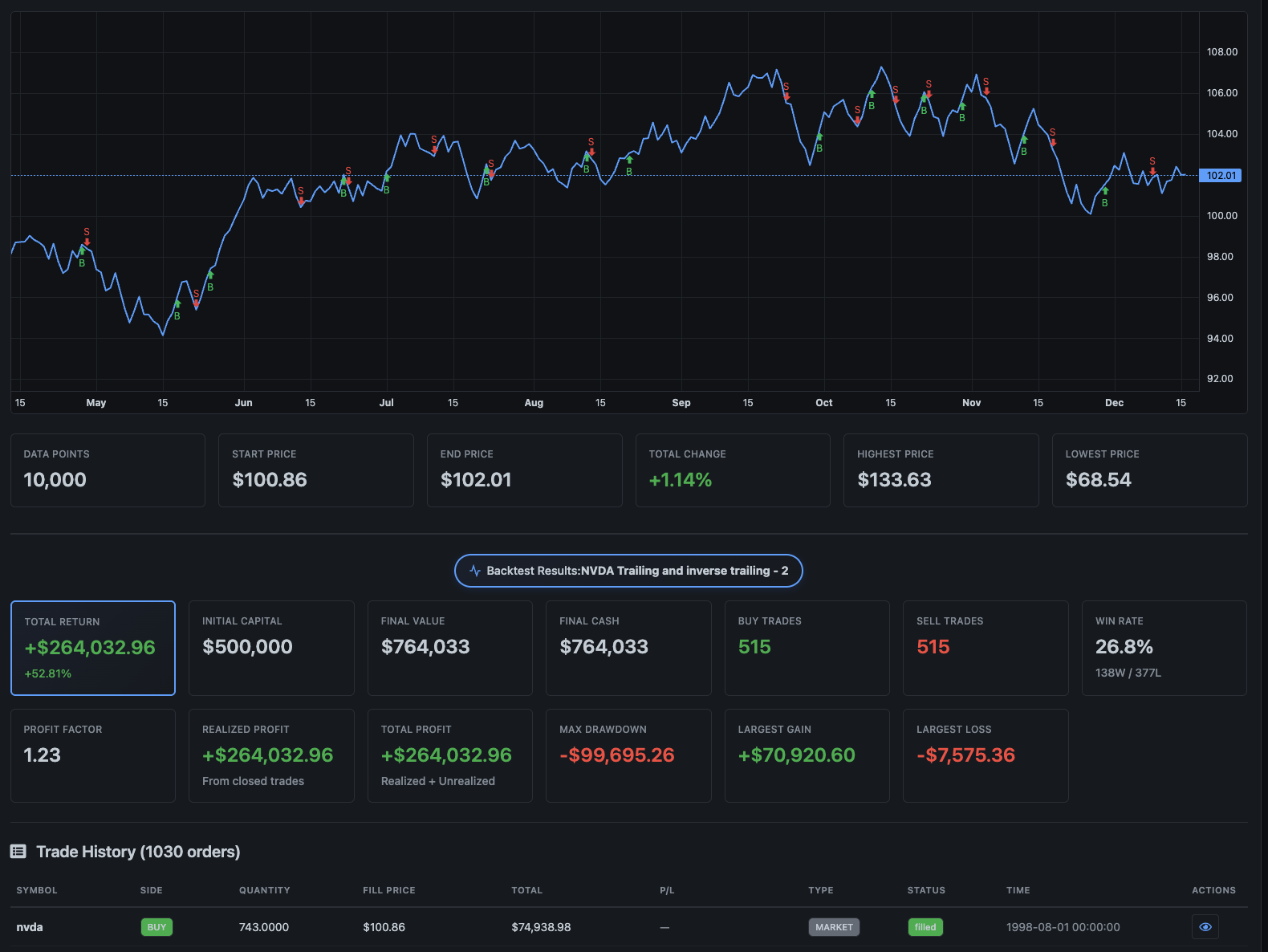

Imagine this scenario: you've got a momentum script running on NVDA that buys dips and sells on profit targets. The market opens, you head into a meeting, and three hours later you check your phone to find your script executed five trades while you were gone.

Wouldn't it be nice to know about those trades as they happen? That's exactly what DipSkip alerts provide. You maintain full awareness of your strategy's activity without needing to keep a browser tab open all day.

Five Alert Types for Every Situation

DipSkip offers five distinct alert types, each designed for specific monitoring needs:

1. Symbol Price Alerts

The simplest alert type—get notified when any stock hits a target price. This works independently of your scripts, making it perfect for watching stocks you're not currently trading.

Example: Set an alert for AAPL at $180. When Apple hits that price, you get an email—whether or not you have a script running on it.

2. Loss Amount Alerts

Early warning for when positions move against you. Set a threshold in dollars or percentage, and select which scripts to monitor. You'll know immediately when losses reach your limit.

Example: Set a -10% loss alert on your TSLA script. If your position drops 10%, you get notified instantly—giving you time to review the situation before any stop-loss triggers.

3. Gain Amount Alerts

Celebrate your wins and stay aware of profit targets. Configure in dollars or percentage terms for selected scripts.

Example: Set a +$500 gain alert. When your cumulative profit hits that milestone, you'll know it's time to pop the champagne (or consider taking some profits).

4. Buy Trade Alerts

Know when your scripts are entering positions. Choose to be notified on every buy, or only after a certain number of buys—useful for strategies that average down.

Example: Your dip-buying script is set to accumulate up to 5 positions. Set a buy alert after 3 trades to know when you're getting deep into averaging down territory.

5. Sell Trade Alerts

Stay informed when your scripts exit positions. Like buy alerts, configure for every trade or after a threshold.

Example: Set sell alerts to "every trade" so you know the moment your script locks in profits or cuts losses.

Smart Alert Strategies

Here are some practical ways to use alerts effectively:

The Early Warning System

If your script has a stop-loss at -15%, set a loss alert at -10%. This gives you advance notice that things are moving against you, time to review the position, and the option to manually intervene before the automated stop triggers.

Trade Activity Monitoring

For active day trading scripts, set buy and sell alerts to "every trade." You'll have a real-time log of activity in your inbox, which is perfect for reviewing when you have a moment.

Milestone Tracking

Use gain alerts as milestone markers. Set alerts at +5%, +10%, +15% to track your progress throughout the day. It's motivating and keeps you informed without obsessive chart-watching.

Pro Tip: Combine alerts with your script logic for layered protection. Your script handles the automation, alerts keep you informed, and you maintain the option to manually override when needed.

Getting Started

Setting up alerts takes just a few seconds:

- Navigate to the Alerts tab in DipSkip

- Select your alert type from the dropdown

- Configure the trigger conditions

- For script-based alerts, select which scripts to monitor

- Click Add Alert

That's it. From now on, you'll receive email notifications whenever your conditions are met.

The Balance of Automation and Awareness

The best automated trading setup isn't one where you're completely disconnected—it's one where you're appropriately informed. Too many alerts and you're back to watching the market all day. Too few and you miss important events.

Find your balance. Maybe that's just sell alerts so you know when trades complete. Maybe it's loss alerts as a safety net. Or maybe it's everything, because you like staying in the loop.

Whatever your style, DipSkip alerts let you stay informed on your own terms—keeping you connected to your strategies while your scripts do the heavy lifting.

Check out the Alerts documentation for complete details on each alert type and configuration options.